Your business success relies heavily on effective financial management. But not every business is in a position or has the desire to hire an in-house bookkeeper — and they don’t need to. Many organizations are turning to virtual bookkeepers due to their ability to adeptly track, record, and seamlessly manage financial tasks. Curious how? Let’s find out.

Full-time bookkeepers usually demand an average annual salary ranging from $48,000 to $70,000, along with benefits and overhead expenses, depending on where they work. On the other hand, virtual bookkeepers are much more pocket-friendly. With cloud-based accounting tools, accurate records, and increased efficiency for informed decision-making, virtual bookkeepers can revolutionize the way you manage your finances.

Getting your books right virtually is more cost-effective. In fact, 90% of businesses have embraced hybrid work models, allowing their employees to work virtually from off-site locations (including home) for some or much of the time. Only about 10% continue to work in a traditional office setting. In this case, businesses prefer a virtual bookkeeper that can simplify financial operations with ease and flexibility.

According to Investopedia, small companies choose to outsource bookkeeping as it is more cost-effective than having an in-house accountant. The global finance and accounting business process outsourcing market size is expected to reach $93.2 billion by 2028, rising at a market growth of 9.2% CAGR during the forecast period (2018-2028).

Image Source: Research And Markets

By offloading the time-consuming and complex task of bookkeeping to external experts, companies can redirect their internal resources towards growth-oriented activities, such as product development, marketing, and customer engagement. This enhanced focus on core business activities not only improves overall efficiency but also contributes to a competitive edge in the market.

Companies are recognizing the immense benefits of partnering with credible virtual staffing providers. The cloud-based approach allows businesses and their outsourced bookkeeping partners to collaborate seamlessly, regardless of geographical barriers, enabling efficient data sharing and reporting. Let’s learn further about the responsibilities of a virtual bookkeeper.

Understanding the Role of a Virtual Bookkeeper

Unlike traditional bookkeepers who work on-site, virtual bookkeepers provide accounting and bookkeeping services remotely. Let’s delve into the essential aspects of a virtual bookkeeper’s role:

Responsibilities of Virtual Bookkeeping

- Financial Data Entry and Maintenance: Virtual bookkeepers handle the accurate and timely entry of financial data into digital systems, ensuring the records are up-to-date.

- Bank Reconciliation: They perform regular bank reconciliations to match transactions and maintain the accuracy of financial records.

- Invoicing and Payments: Virtual bookkeepers handle invoicing clients and managing accounts payable and receivable to facilitate smooth cash flow.

- Expense Tracking: They track business expenses, categorizing and recording them for budgeting and tax purposes.

- Financial Reporting: Virtual bookkeepers generate financial reports like profit and loss statements, balance sheets, and cash flow reports to help businesses make informed decisions.

- Tax Preparation Support: They assist in gathering necessary financial data and preparing documentation for tax filings.

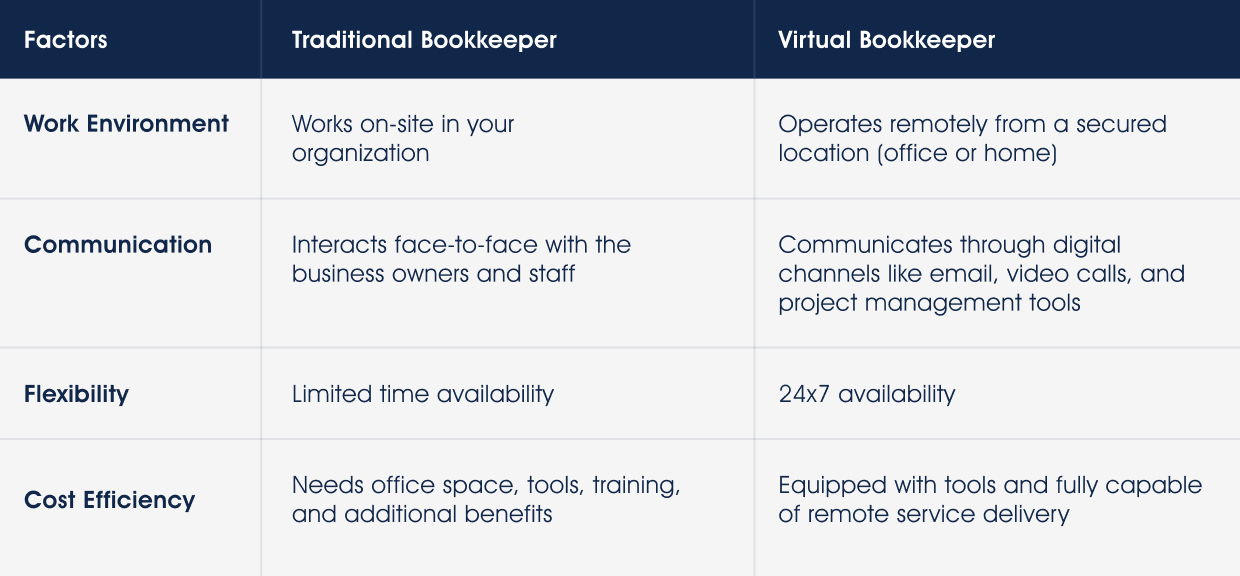

Differences Between Traditional and Virtual Bookkeepers

Virtual bookkeepers use technology to streamline their processes, providing a seamless and secure way to handle your accounting needs remotely. Their reliance on cloud-based accounting software and automation tools ensures faster and more accurate data entry, reducing the risk of errors and enabling real-time collaboration.

Qualifications and Skills Required in a Virtual Bookkeeper

- Bookkeeping Knowledge: A virtual bookkeeper must possess a strong understanding of accounting principles, financial procedures, and bookkeeping software.

- Tech Proficiency: Being adept in various accounting software and cloud-based tools is essential for virtual bookkeepers to work efficiently.

- Time Management: Virtual bookkeepers should manage their time effectively to meet deadlines and handle multiple clients if they work for an agency.

- Communication Skills: Excellent communication skills are vital for clear client interactions and understanding specific business needs.

- Data Security Awareness: Virtual bookkeepers must prioritize data security and confidentiality when handling sensitive financial information.

- Problem-Solving Abilities: Troubleshooting discrepancies and finding solutions to financial issues are crucial aspects of a virtual bookkeeper’s role.

By understanding the responsibilities, differences, and qualifications of a virtual bookkeeper, businesses can make informed decisions when opting for this modern approach to managing their financial records.

Common Concerns for Hiring a Remote Bookkeeper and How Flowz Helps

Embracing the efficiency of a virtual bookkeeper might raise concerns. Discover common challenges and how Flowz delivers reliable solutions, ensuring peace of mind in your financial management.

Communication and Time Zone Differences

Hiring a virtual bookkeeper from a different time zone can pose challenges in terms of effective communication and collaboration. Key concerns include delayed responses, difficulty in scheduling meetings, and potential miscommunications due to varying working hours.

Flowz, a leading remote staffing services provider with locations worldwide, offers the following solutions to overcome these challenges:

- Flexible Communication Channels: Our virtual bookkeepers use diverse communication tools like emails, instant messaging, video conferencing, and project management platforms, ensuring seamless interaction regardless of time zones.

- Establishing Communication Norms: We set clear expectations and response timeframes, maintaining open lines of communication and addressing urgent queries promptly.

- Scheduling Regular Meetings: Our virtual bookkeepers are available across different time-zones and schedule regular meetings to discuss financial updates, address concerns, and maintain strong client-bookkeeper relationships.

- Dedicated Regional Teams: Our global presence allows us to establish dedicated regional teams of virtual bookkeepers, ensuring that clients receive personalized support that aligns with their local business practices, regulations, and cultural nuances. These teams are well-versed in the specific requirements of different regions, providing you with a tailored and efficient bookkeeping experience.

Ensuring Data Security and Privacy

Entrusting sensitive financial data to a remote bookkeeper raises concerns about data security and privacy breaches. Clients worry about unauthorized access to financial records, potential data leaks, and the implications of mishandled information.

Flowz ensures top-notch security with the following measures:

- Implementing Secure Systems: Our virtual bookkeepers utilize secure cloud-based accounting software and encryption protocols to safeguard client data from unauthorized access.

- Signing Non-Disclosure Agreements: We build trust by having our virtual bookkeepers sign non-disclosure agreements (NDAs), legally binding them to maintain strict confidentiality.

- Regular Data Backups: With regular data backups, we guarantee that crucial financial information remains safe and accessible in case of unforeseen events.

- Regular Security Audits: We conduct periodic security audits to assess and strengthen our compliance with HIPAA, GDPR, and CCPA regulations. These audits ensure that our security measures are up-to-date and in line with the latest industry standards, providing an added layer of protection for our clients’ sensitive information.

Managing Multiple Accounts and Workload

Virtual bookkeepers often deal with multiple clients and accounts simultaneously, which can lead to difficulties in task prioritization, meeting deadlines, and maintaining quality standards across all clients.

Flowz provides the following solutions to overcome this challenge:

- Effective Task Prioritization: Our virtual bookkeepers prioritize tasks based on deadlines and urgency, ensuring all clients receive timely attention.

- Automation and Technology: Leveraging automation tools for repetitive tasks streamlines bookkeeping workflow and enhances productivity for our remote bookkeeping assistants.

- Collaborative Platforms: Our virtual bookkeepers use project management tools to collaborate efficiently with clients, keeping track of tasks, deadlines, and progress.

- Dedicated Account Manager: Each client is assigned a dedicated account manager or team leader for personalized support and efficient communication.

Building Trust and Establishing Long-Term Relationship Remotely

Establishing trust with a remote bookkeeper you have not met in person can be challenging. You may be hesitant to share sensitive financial information with someone you have not physically interacted with, and building a long-term professional relationship can be more challenging without face-to-face interactions.

Flowz focuses on building long-term relationships through:

- Transparent and Ethical Practices: Our remote bookkeepers maintain transparency in bookkeeping processes and adhere to ethical standards, instilling confidence in clients.

- Excellent Client Service: We prioritize delivering high-quality services and being responsive to client needs, fostering trust and satisfaction.

- References: We provide references and case studies from existing clients, showcasing credibility and reliability.

- Strong Credentials: We ensure that our clients benefit from the most accurate and efficient bookkeeping services, backed by over 23 years of expertise and experience serving more than 4,200 satisfied clients.

With Flowz’s remote bookkeepers, you can overcome these common challenges and experience smooth and efficient bookkeeping services.

Hear what one of our clients had to say about her outsourcing experience with us. –

Check out Flowz’s Virtual Bookkeepers.

10 Proven Benefits of a Virtual Bookkeeper for Your Business

1. Cost-Effective Solution

Hiring a full-time, in-house bookkeeper can be expensive, especially for small businesses and startups. On the other hand, a virtual bookkeeping assistant offers a cost-effective solution as you only pay for the services you require, avoiding additional overhead expenses.

2. Bookkeeping Expertise and Accuracy

Virtual bookkeeping assistants are professionals with extensive knowledge and expertise in financial management. Their skills ensure accurate bookkeeping, reducing the risk of errors that could have significant consequences for your business.

3. Enhanced Time Management

A virtual bookkeeping assistant can efficiently manage your financial records, allowing you and your team to concentrate on essential business operations. By handling time-consuming bookkeeping tasks, they free up your schedule, providing you with more time to grow your business.

4. Data Protection and Confidentiality

Keeping financial data secure is crucial for any business. Virtual bookkeeping assistants use encrypted platforms and follow strict protocols to maintain the confidentiality and security of your financial information.

5. Access to Advanced Tools

Virtual bookkeeping services providers leverage modern software and tools to streamline bookkeeping processes, providing real-time insights into your financial health. This access to advanced technology enhances decision-making within your business.

6. Scalability and Flexibility

As your business expands, your bookkeeping requirements will also increase. Virtual bookkeeping assistants offer scalability, adapting to your evolving requirements, and ensuring your financial management stays efficient at all stages.

7. Better Cash Flow Management

A virtual bookkeeping assistant can help optimize your cash flow by managing invoicing, payment processing, and monitoring expenses, ensuring your business stays financially healthy.

8. Reduced Tax Filing Stress

Tax preparation can be stressful and time-consuming, but with a virtual assistant bookkeeping, you can be confident that your records are well-organized and accurate, making the tax filing process smoother.

9. Access to Real-Time Financial Reports

Virtual bookkeeping assistants can generate real-time financial reports, providing you with a clear picture of your business’s financial performance. This information is invaluable for making informed decisions and identifying areas for improvement.

10. Peace of Mind to Focus on Priorities

Knowing that your financial records are in capable hands brings peace of mind. You can confidently focus on running your business, while the bookkeeping aspect is being handled efficiently.

Integrate a Virtual Bookkeeper in Your Financial Workflow Today

Embracing virtual bookkeeping is not just a smart move, but a strategic investment towards the financial health of your business. Virtual bookkeepers pave the way for you to focus on core competencies and make well-informed decisions, fostering sustainable growth.