Ensuring your business aligns with financial compliance requirements is crucial to prevent penalties. However, the repercussions of non-compliance extend beyond the bottom line. If you’re aiming to tackle compliance challenges without a full-time CFO, virtual CFO services offer a strategic solution.

Let’s learn how businesses are harnessing virtual CFO services to navigate complex financial regulations.

The Changing Landscape of Financial Compliance

The spotlight on compliance has intensified, reshaping priorities for businesses and financial institutions. With 62% of CFOs acknowledging the growing significance of tax and compliance, the intricate relationship between financial stability and regulatory adherence has come to the forefront.

In the year 2021, financial institutions failing to meet compliance and due diligence standards received fines amounting to around $2.7 billion. The majority of these fines were imposed due to violations of the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations.

The imposition of a $29 million penalty on Bittrex, a crypto exchange, is a recent example of the enforcement of AML regulations in the US.

Along with AML, attention is directed toward financial regulations including the BSA’s Consumer Identification Program (CIP), Know Your Customer (KYC), Patriot Act (An Anti-terrorism Regulation), and Gramm-Leach-Bliley Act (GLBA). These regulations are designed to counter money laundering, ensure proper customer identification, and safeguard financial privacy.

In addition, the emphasis on controls for financial reporting and healthcare data privacy is highlighted by the Sarbanes-Oxley Act (SOX) and Health Insurance Portability and Accountability Act (HIPAA).

Major Challenges for Financial Compliance

→ Increasing Non-compliance Penalties

→ Lack of Proper Financial Analytics

→ Tightening Budgets

→ Potential Shortages of Skilled Professionals

As compliance costs surge, 66% of respondents in a 2022 survey anticipate increased expenses for senior compliance staff. Among these, 47% attribute the rise to the demand for skilled professionals well-versed in the intricacies of compliance.

Understanding Virtual CFO Services for Your Business

A virtual CFO is a seasoned professional who provides strategic financial expertise to businesses on a fractional or interim basis. Unlike traditional CFO, virtual CFOs offer their services as and when needed, making it a cost-effective strategy for small to medium-sized businesses.

What Virtual CFO Services Bring to the Table?

- Developing Financial Policies: These services involve the creation of well-defined accounting policy frameworks, ensuring the clarity of both accounting and management practices.

- Financial Consultation: Functioning as Virtual CFOs, these services enhance the stability of a company’s financial aspects. By implementing effective financial processes and carefully analyzing financial data, a virtual CFO enables enterprises to prioritize more crucial aspects of their operations.

- Compliance Adherence: Virtual CFOs diligently work towards meeting essential financial compliance regulations.

- Expenditure and Debt Oversight: Virtual CFOs assist companies in managing their expenses and debts effectively, thereby preventing potential financial issues. This proactive approach helps ensure financial stability.

- Virtual Accounting Services: These offerings empower enterprises to take control of their accounting endeavors. A fractional CFO assists in formulating, constructing, and submitting financial statements within deadlines. Additionally, they provide support in documenting and filing taxes.

- Support for Auditing: Virtual CFO services provide comprehensive auditing support throughout the process.

- Virtual Bookkeeping Services: These services manage and organize fiscal transactions systematically, maintain accurate and up-to-date records of income and expenses, ensuring the precision of financial data.

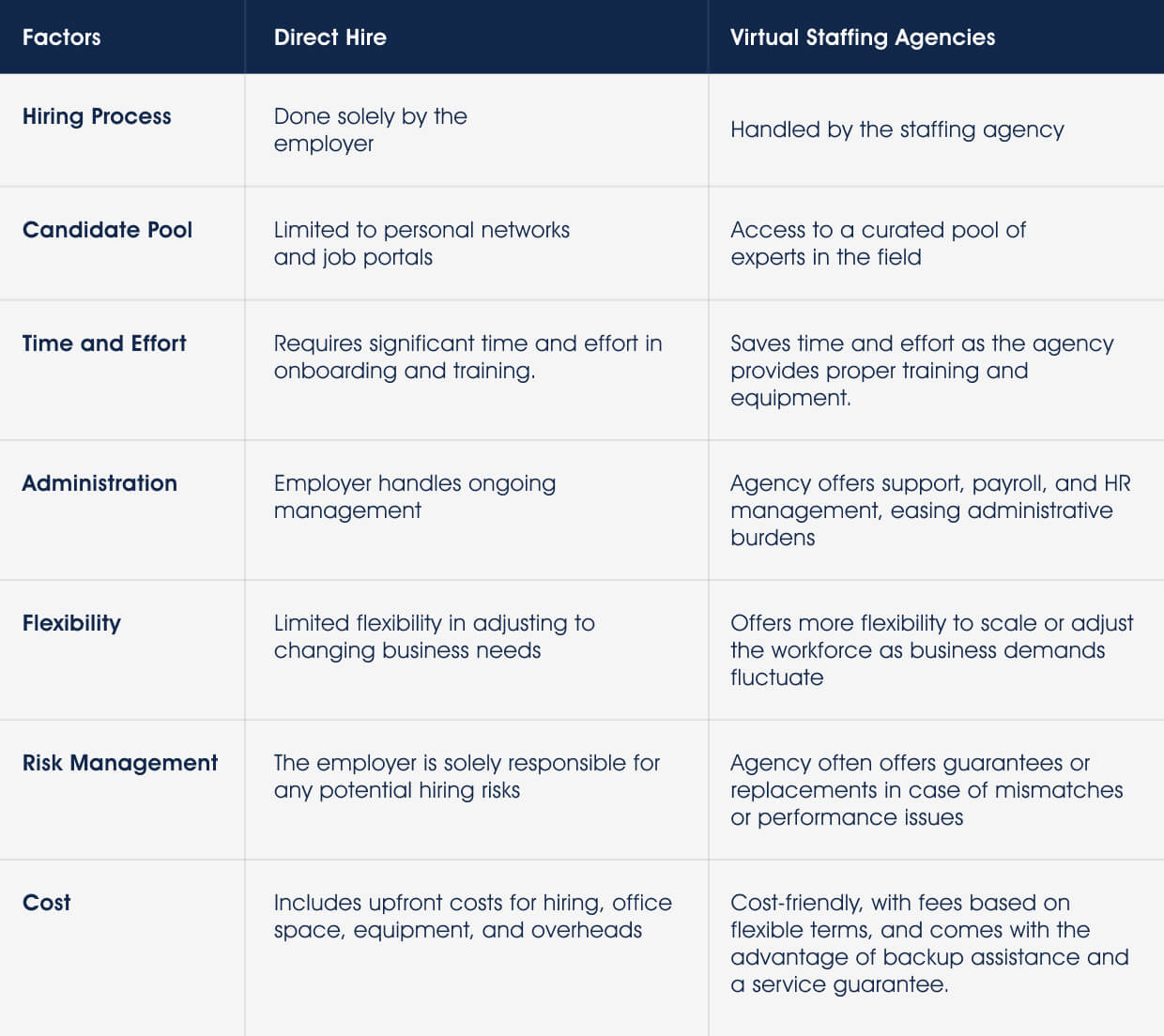

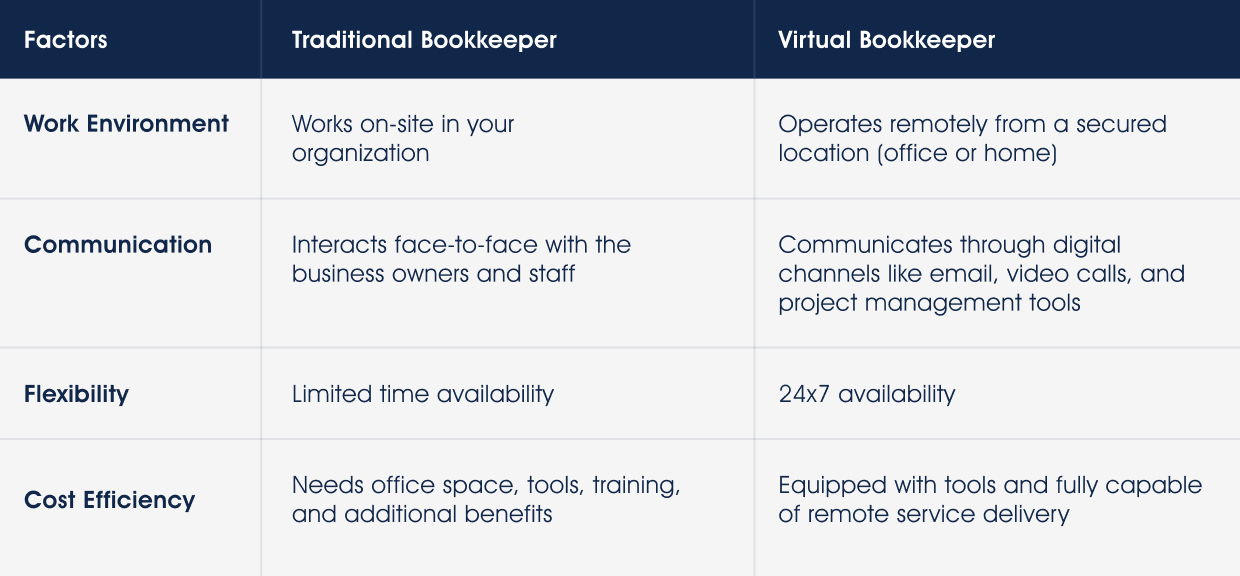

Virtual CFO Services vs. In-House CFO

Virtual CFO services are proving beneficial for both corporate enterprises and small to medium-sized businesses (SMEs). However, it’s important to understand the distinctions between an in-house CFO and a virtual counterpart to make an informed decision aligned with your specific financial needs and goals.

Experts emphasize that having a seasoned compliance professional with a reputable track record on your team is considered a best practice. Just as a skilled co-pilot assists a pilot in navigating challenging skies, a virtual CFO serves as your strategic co-pilot, steering your business towards financial success while ensuring adherence to all the necessary compliance measures.

How Virtual CFO Services Help Ensure Compliance?

Gone are the days when compliance was merely a checkbox exercise; today, it’s a dynamic process that requires proactive measures and continuous vigilance. From leveraging cutting-edge tools to staying updated on regulatory shifts, virtual CFOs bring a new dimension to compliance management. Here’s how:

Expert Guidance on The Regulatory Landscape

Navigating the intricate web of financial regulations is a challenge that every business faces. To solve this, virtual CFOs possess substantial expertise and knowledge. They keep abreast of the latest changes in tax laws, accounting standards, and industry-specific regulations. By staying updated, virtual CFOs ensure that businesses remain compliant, avoiding hefty penalties and legal troubles.

Developing and Implementing Effective Compliance Strategies

One-size-fits-all approaches rarely work in the world of compliance. Every business has unique needs and requirements. A fractional CFO collaborates closely with business owners to understand their specific operations, financial structure, and industry landscape. This in-depth understanding allows virtual CFOs to develop tailored compliance strategies that address the business’s unique challenges and goals.

Continuous Monitoring and Risk Mitigation

Compliance is not a one-time endeavor; it requires ongoing monitoring and adjustments. Virtual CFOs establish robust monitoring systems that track financial activities, ensuring they align with regulatory standards. By identifying potential risks early on, virtual CFOs help mitigate compliance-related issues before they escalate.

Streamlining Financial Processes

Efficient financial processes are essential for maintaining compliance. Virtual CFOs streamline financial workflows, optimizing the process through precise bookkeeping and financial reporting. The services not only ensure accuracy but also saves time and resources, allowing businesses to focus on their core operations.

Driving Financial Growth Through Compliance

Compliance isn’t just about avoiding penalties; it can also drive financial growth. Virtual CFOs analyze financial data to identify trends and opportunities. By aligning compliance efforts with the business’s financial goals, virtual CFOs help in making informed decisions that propel the business forward.

Related Content: The Virtual CFO Services & CFO Trends Shaping Up Finance

Explore Flowz’s Virtual CFO Services

Our dedicated CFOs bring a wealth of expertise to the table, offering specialized skills without the need for a full-time commitment. Whether you’re a small startup or an established enterprise, Flowz’s Virtual CFO Services are tailored to fit your unique needs. You benefit from financial planning, analysis, and reporting that is designed to drive better decision-making.

Why Choose Flowz’s Virtual Chief Financial Officer Services?

- Comprehensive Financial Expertise

Our Virtual CFO services handle all facets of financial operations, including robust reporting, accurate forecasting, strategic planning, meticulous budgeting, insightful analysis, and effective cash management. Our proficiency also encompasses virtual accounting services, ensuring that your financial strategies are seamlessly integrated into your overall business objectives.

- Collaborative Team Player

With their financial systems expertise, our CFOs lead teams in simplifying complex tasks and establishing world-class processes, fostering collaboration and coherence throughout your organization.

- Business Acumen

We find optimal solutions for even the most challenging issues. Our CFOs continually enhance quality through hard evidence and deep knowledge, supported by our virtual bookkeeping services, which guarantee precise and up-to-date financial records for informed decision-making.

- Results-Driven Approach

The virtual CFOs at Flowz embody a proactive “can-do” attitude, maintaining composure under pressure. Setting high standards and consistently surpassing expectations, we ensure that your financial management is in the hands of dedicated professionals.

Check out our Virtual CFO Services.

Accelerate Your Compliance Strategy with Trusted Virtual CFO Services

Your virtual CFO acts as a beacon of strategic foresight and efficiency in compliance. The services effectively bridge the gap between the need for top-tier financial expertise and your business’s ability to attain it, which is truly a winning strategy. Overcome the challenges of increasing compliance costs, complex regulations, and talent shortages by partnering with a reliable virtual CFO services provider today.