NAVIGATING RESPONSIBLE AI ADOPTION IN INSURANCE CLAIMS AND UNDERWRITING

Balancing Intelligent Automation And Digital Trust

JULY 2023

Enchie Go

Created By

Reviewed By

Shapnila Nath

@Flowz

Marketing Director

@Flowz

Content Marketing Manager

Balancing Intelligent Automation And Digital Trust

2

TABLE OF CONTENTS

1. Foreword

2. Current Outlook: Claims and Underwriting

3. Exploring the Boundless Potential of AI

4. Challenges and Considerations

5. Building Digital Trust for Responsible AI

6. Data References

7. About Flowz

Balancing Intelligent Automation And Digital Trust

3

Foreword

As with most industries, insurance has endured its share of disruptions over the past few years. The lingering effects of a global pandemic and geopolitical tensions pushed a once risk-averse sector to its limit. These unprecedented conditions, coupled with the increasing emphasis on digital technologies, helped artificial intelligence gain the endorsement of a seemingly bureaucratic field.

Additionally, the constant influx of new market entrants and technology-led innovators called Insurtechs is changing the status quo. To maintain this momentum and meet the inevitable challenges that lie ahead, insurers will need to do more than just explore the potential of AI.

This whitepaper examines the use and scope of artificial intelligence in two primary areas of insurance operations – Claims and Underwriting. Additionally, it elaborates on some guidelines for maximizing automation while considering the ethical and regulatory complications that come with the territoryCurrent Outlook: Claims and Underwriting

For a heavily regulated and data-driven industry such as insurance, AI represents a paradigm shift in meeting customer expectations regarding on-demand quotes, digital self-service, and tailored products. But, before we could explore AI’s limitless potential in insurance claims and underwriting, it is vital to understand the current market dynamics that support intelligent automation.

Insurance Claims

Research indicates that unsatisfactory claims experience is one of the key reasons driving customers to switch insurance carriers. Policyholders are increasingly looking for insurers who can offer painless, prompt settlements with a personalized touch.

Accenture recently surveyed three distinct groups to better understand insurer and customer pain points. The respondents comprised 6,784 Home and Auto policyholders across 25 countries who had claimed insurance over the last two years; 128 Insurance Claims Execs from 13 countries; and 434 US-based Underwriters. Around a third of the claimants (31%) were not completely satisfied with their most recent claims experience. Over the next five years, this number could represent a whopping US$ 170 billion in premiums.

Additionally, around 30% of dissatisfied claimants admitted to switching insurance carriers in the past two years, and another 47% said they were considering doing so.

Balancing Intelligent Automation And Digital Trust

4

Insurance Underwriting

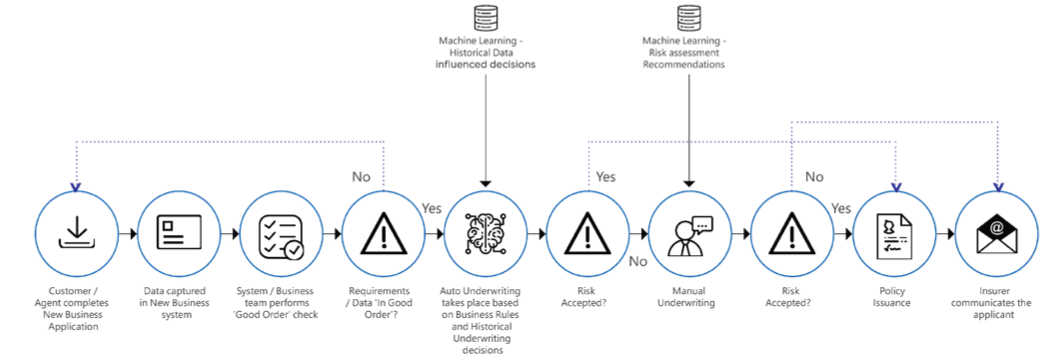

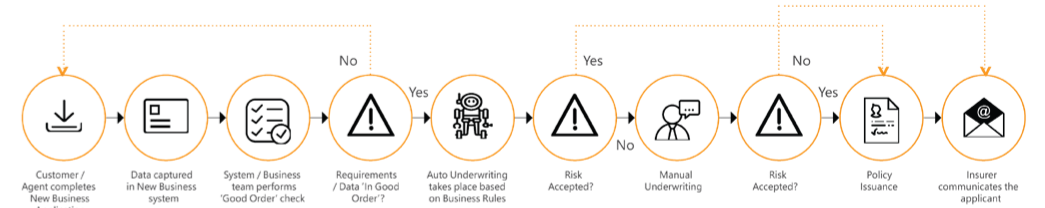

Textbook Insurance Underwriting calls for a labor-intensive process of assessing the risk of a potential policyholder and determining their premium amount based on the documentation provided. It involves going through piles of physical and digital paperwork, multiple data updates, and several rounds of coordination between client representatives, decision-makers, and third parties.

To remedy this process, some life insurers leverage ‘Auto Underwriting’ or ‘Straight Through Processing,’ which works on a set of predefined business rules. The applications that pass these rules are issued policies, while those that fail are sent for manual underwriting.

Balancing Intelligent Automation And Digital Trust

5

However, this rule-based process can be further refined when combined with the endless potential of AI.

Exploring the Boundless Potential of AI

AI in Claims Processing

Automated Claims Intake and Triage

The claims intake process managed by contact centers comprises around 40% of inbound call volume. Most of these queries are repetitive and include basic claims status checks, which become a huge cost risk for insurers. By implementing AI-driven outbound status messages, insurers can deliver improved customer experience and efficiency gains of reduced inbound calls.

Similarly, the current claims intake process is riddled with an ever-increasing volume of complicated claims making it challenging for manual triages to segregate high-cost from low-cost claims. This is especially true in the case of Life Insurance, where complications arising from fatal injuries or accidents may seem malignant at first, but increase in cost over time. Moreover, claims that are triaged manually basis the limited information taken at First Notice Of Loss (FNOL), are prone to encounter delays, incompleteness, and inaccuracies in data collection.

Thankfully, predictive AI’s ability to mimic human thoughts and triage claims now makes it possible for insurers to identify hard-to-detect high-cost claims. AI-powered tools can also alert claims professionals to reroute such claims to the appropriate channels while low-cost claims are autoadjudicated and resolved swiftly.

Moreover, advances in Natural Language Processing (NLP) have made it possible to scan through clusters of data – even unstructured data sets – and extract information that might have been missed in the first instance. AI automated triage models run consistently and uncover previously hidden information, like references to a surgery or an attorney’s involvement. This makes AI-powered triage processing less subjective and more accurate.

Balancing Intelligent Automation And Digital Trust

6

Compensa Poland, a subsidiary of Vienna Insurance Group (VIG), has elevated its customer experience with a self-service claims-handling solution. It uses advanced data analytics to automatically process claims from First Notice Of Loss (FNOL) to smart claims segmentation, routing, assessment, settlement, and adjusting the claims reserve. The AI-based system has achieved a 73% increase in claims process cost efficiency. Also, 50% of customers who used the self-liquidation application said they would recommend it to a friend or family member.

Automated Claims Intake and Triage

In August 2005, the aftermath of Hurricane Katrina amounted to around US$ 100 billion in economic damages. Out of the US$ 80 billion government funding allocated for reconstruction purposes, fraudulent charges accounted for US$ 6 billion.

QA & Software Testing Services provider TestingXperts developed an intelligent claim validation software for one of the largest independent insurance companies in the U.S. By leveraging AI and intelligent RPA (Robotic Process Automation) to analyze and validate claims, it generates accurate loss reports. As a result, claims accuracy improved by up to 99.99%, operational efficiency by 60%, and customer experience improved by 95%.

Intelligent Fraud Detection and Prevention

Balancing Intelligent Automation And Digital Trust

7

Instead of manual intervention, many Insurtechs are using Computer Vision (CV) to decode visual inputs pertaining to claims. CV has the extraordinary ability to analyze Geospatial Information (GIS) collected from satellites and videos or images captured by customers and drones. This helps insurers instantly evaluate the damage caused to property, vehicles, or homes and thereby assess the cost of loss.

Furthermore, the recent developments in NLP have successfully automated a predominantly manual claims assessment process. A heavily regulated industry such as insurance highly advocates the usage of paper-based forms and printed documents. This makes it overly time-consuming for insurers to update data and settle claims.

Enter Optical Character Recognition (OCR), an NLP application with the ability to read handwritten text and figures. Claims executives can now forgo manual data entry and benefit from an automated data-capturing process.

Yet another useful tool for automating claim assessment is intelligent chatbots. Instead of waiting for a specialist to submit their FNOL, claimants can now interact with readily available NLP-powered chatbots to quickly process queries such as uploading photos/videos that validate their claim

U.S.-based insurance firm Lemonade employs chatbots to guide customers through policy applications. In lieu of the usual convoluted form, chatbots ask customers a series of questions. Based on their responses, they receive a quotation within 90 seconds.

AI in Underwriting

Daido Life Insurance in Japan is a formidable underwriting use case for AI. The company has built a powerful AI prediction model that visualizes the decisionmaking process and enables underwriters to perform assessments while checking the AI’s prediction results and cautionary points. This model improves back-office efficiency while solving the AI black box problem through human verification of AI predictions. Daido Life will continue to refine the model by accumulating underwriting results from AI predictions and human judgment.

Policy Automation

Balancing Intelligent Automation And Digital Trust

8

Risk Prevention

“Insurance providers can now make dynamic projections about future outcomes, with a continuously updated view of the underlying risk. And they can develop consumption-based pricing models that update in tandem.”

Manan Sagar

Insurance CTO, Fujitsu EMEIA

Artificial intelligence is helping insurance become a service-oriented product that focuses more on predicting risk than mitigating it. This is made possible by AI’s ability to analyze vast amounts of data and detect patterns in risk causes. Identifying such patterns in real-time data will allow insurers to intervene before a catastrophe arises.

It is anticipated that auto insurers will be among the first to benefit from this predictive modeling since they already have telematics devices in place to track and assess driver behavior in real-world situations. As AI matures, this mechanism can operate in real-time, penalizing drivers for speeding beyond the allotted speed limit. Very soon we could have push notifications at junctions that compare the predictability of taking one route over the other.

Similar advancements are likely to occur in life insurance where customers receive notifications from wearables to improve their overall health quality and prevent strain on health services. As ML “Insurance providers can now make dynamic projections about future outcomes, with a continuously updated view of the underlying risk. And they can develop consumption-based pricing models that update in tandem.” Manan Sagar Insurance CTO, Fujitsu EMEIA Source: Fujitsu 8 NAVIGATING RESPONSIBLE AI ADOPTION IN INSURANCE CLAIMS AND UNDERWRITING Balancing Intelligent Automation And Digital Trust identifies more granular patterns, these predictions will get more accurate which will reduce risk to policyholders and costs for insurers.

Balancing Intelligent Automation And Digital Trust

9

Subjective Risk Assessment and Fair Pricing

Mckinsey predicts that there will be up to one trillion connected devices by 2025. Through the use of artificial intelligence, insurers will be able to accurately determine the risk profile of a policyholder and set a fairer and more customized premium rate by integrating data from multiple connected consumer devices such as health trackers, smartphones, cars, and home appliances.

Using this method, insurance carriers can move from an objective to a highly personalized risk assessment, removing any conscious or unconscious biases. These connected services are expected to have real-time capabilities within a few years, allowing policy adjustments on-the-spot based on shifts in personal data.

Data-driven risk management will be the driver behind accurate pricing models. AI can scan large volumes of data, such as customer demographics and preferences, to identify trends in risk profiles and develop tailored solutions for each customer. This helps insurers make informed decisions on risk models, policy terms, and pricing strategies. Insurers will ultimately be able to develop policies that will provide coverage and benefits tailored specifically to each individual needs.

At present, moving houses requires a customer to inform the insurer manually. However, with AI integration, the new address could be automatically populated from the postservice database. This can also be cross-referenced against geo-location and property information, like changes in building type and proximity to major water sources.

Source: Fujitsu

From the customer’s perspective, this could result in lower premiums as they would represent a lesser risk than their broader demographic. Similarly, it helps insurers strike a better balance between premium prices and claims.

Risk Mitigation

When it comes to mitigating risks, AI’s ability to analyze massive sets of data can help identify potential outcomes of different scenarios, and thus decrease losses significantly. Insurers can leverage behavioral analytics to detect high-risk customers and predictive analytics to understand the long-term effects of their decisions.

For instance, AI-powered Risk Management Information Systems can efficiently detect risks that are hard to point out manually. With the real-time inflow of customer behavior, they can take protective measures before a loss occurs.

Balancing Intelligent Automation And Digital Trust

10

Challenges and Considerations:

Despite the plethora of benefits associated with using artificial intelligence in Claims and Underwriting, it comes with its own set of regulatory and ethical challenges. AI-based decisions have a history of bias, especially when driven by corrupted or incomplete data sets. Insurers will need to consider a variety of factors like governance, organizational and cultural conditions, in addition to authentic data.

Claims

By automating the manual and redundant processes in Claims, AI can drastically reduce claim settlement timelines and drive seamless customer service. However, when it comes to disputed claims or obscure policy wordings, human intervention can help interpret technical lingo and make informed decisions. Additionally, humans outperform AI when it comes to empathizing with a claimant undergoing traumatic events and developing a personal connection.

Similarly, while chatbots can streamline and automate customer interactions, it needs a human touch to nurture relationships and earn repeat customers. Moreover, models based on predictive analysis may fail to assess risk in unforeseen situations due to a lack of adequate data. In such cases, human expertise is essential to provide exceptions and flexibility in unforeseen situations. For instance, the insurance industry breaking stereotypes and exceeding customer expectations during the Black Swan of 2020 is a stellar example of humanity at its best.

Underwriting

While using AI in underwriting to assess risks and determine premiums, any lapses in judgment can have serious legal and reputational consequences for insurers. This can also raise concerns among customers about bias, lack of transparency, and loss of human accountability. Human supervision can ensure that AI algorithms are transparent and accountable, preventing discrimination and unfair treatment of certain segments.

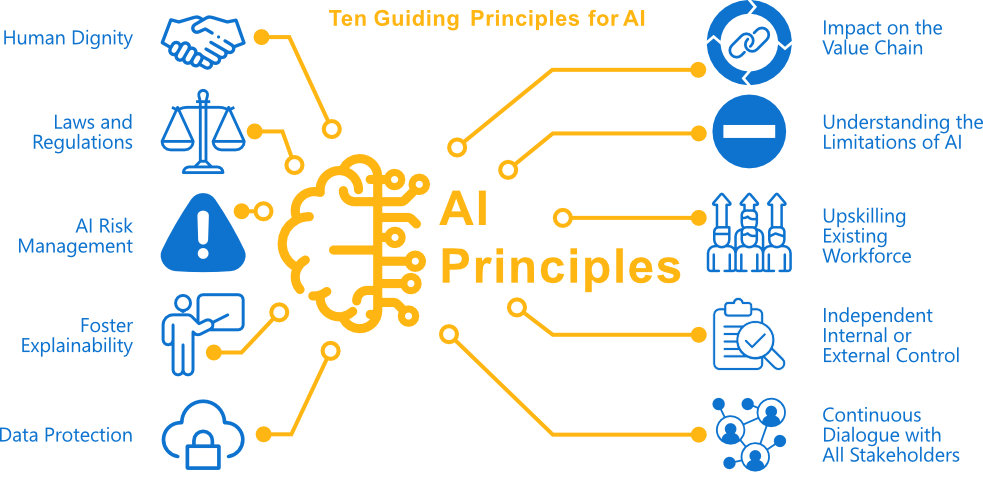

Building Digital Trust for Responsible AI

In an age where it’s become almost impossible to distinguish between human and AI-generated

Balancing Intelligent Automation And Digital Trust

11

content, garnering the trust of customers while automating with AI can be challenging. Gaining

Trust in an AI system lies in understanding how it uses the data to reach fair

and ethical decision-making, without compromising on human dignity.

digital trust will become key for insurers leveraging AI, and hence they need to prepare for an overall reluctance among customers to share data.

SRI’s latest papers on Decoding Digital Trust indicate that trust is not directly proportional to a strong AI infrastructure. Trust in AI is found to be significantly low in developed countries like North America, Germany, France, and the UK, whereas the opposite stands true for developing countries like India, Mexico, and Nigeria. According to the analysis, there is a huge gap between what insurers think builds digital trust (such as digital infrastructure or AI capabilities) and what really matters to policyholders (a sense of purpose, incentives, ease of use, and transparency of AI models).

Therefore, today’s insurers will need to focus on bridging this gap along with harnessing the power of automation. Companies need to invest time and resources in explaining the benefits of data sharing with their customers while facilitating the same through their infrastructure. It also helps a great deal if carriers could leverage customer insights to design insurance products and processes of the future.

Employing experienced insurance support staff can help companies decode complex human emotions and tailor their solutions accordingly. Ultimately, marrying human intuition with AI automation will help insurers drive customer loyalty in the long run.

Balancing Intelligent Automation And Digital Trust

12

About Flowz

Flowz is a pioneer in the remote staffing space. It has provided premium virtual assistants and top remote talent to over 4,000 businesses that have since seen success and growth with outsourcing.

When you find yourself not having the time for sales and other revenue-generating activities, it’s time to outsource. Go to the trusted and proven – Flowz.

Offerings for the Insurance Industry

We offer subject matter experts with years of experience in the promotional products industry. Whether you are looking for topnotch Graphic Designers, App Developers, Customer Support, or Data Entry Reps, we’ve got the crème de la crème for you

- Why AI in Insurance Claims and Underwriting Accenture

- Insurance Fraud FBI

- 3 Ways AI is Changing the Health Insurance Sector in 2023 AI Multiple

- Harnessing the Power of AI in the Insurance Sector Forbes

- How Artificial Intelligence Is Making Insurance Work Better For everyone Fujitsu

- Insurance 2030 McKinsey

- Decoding Digital Trust SwissRe

407 N Pacific Coast Hwy, Ste 584,

Redondo Beach, CA, 900277

1 844 416 4438 US & Canada | 1 800 577 438 Australia & NZ